HELP LINE +91 9883818627

HELP LINE +91 9883818627

Tips Lost Him Money. SIP Built His Wealth

Can’t Save Monthly Automate it with SIP

5 Myths About Term Insurance – Busted!

Start planning today — because the best time to prepare for retirement is when you think it’s too early!

Understand the long-term benefits of SIP over EMI, and make smart wealth-building choices.

Clear the common confusion between insurance and investment—make smarter, goal-based financial decisions.

This animated Reel Video shows investors and prospects how automating SIPs makes investing easy and helps them build wealth.

This Raksha Bandhan, help your clients go beyond symbolic promises by gifting their loved ones lasting financial security through mutual fund investments.

Busts the common myth of needing big money to invest — inspires first-time investors to start with affordable contributions and build wealth confidently through mutual funds.

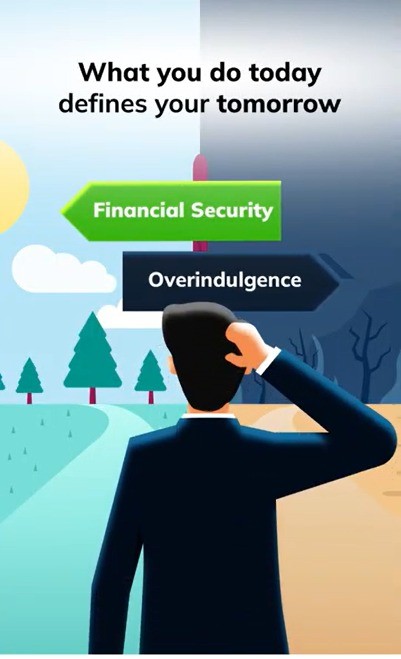

Secure Tomorrow by Investing Today

Small, consistent financial habits can lead to long-term wealth, just like a balanced diet leads to better health.

Learn about the most frequent investing errors—impulse buying, poor diversification, and stopping SIPs and make more informed financial decisions.